How To Do Compound Interest In Excel

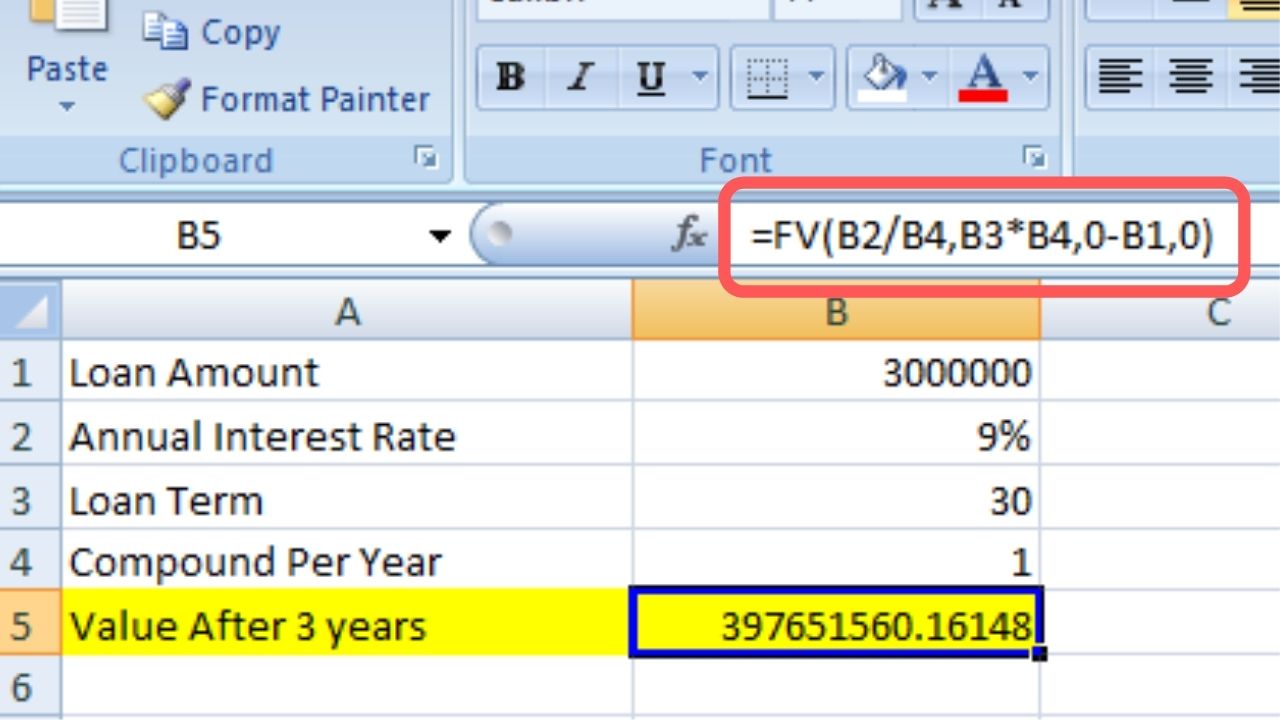

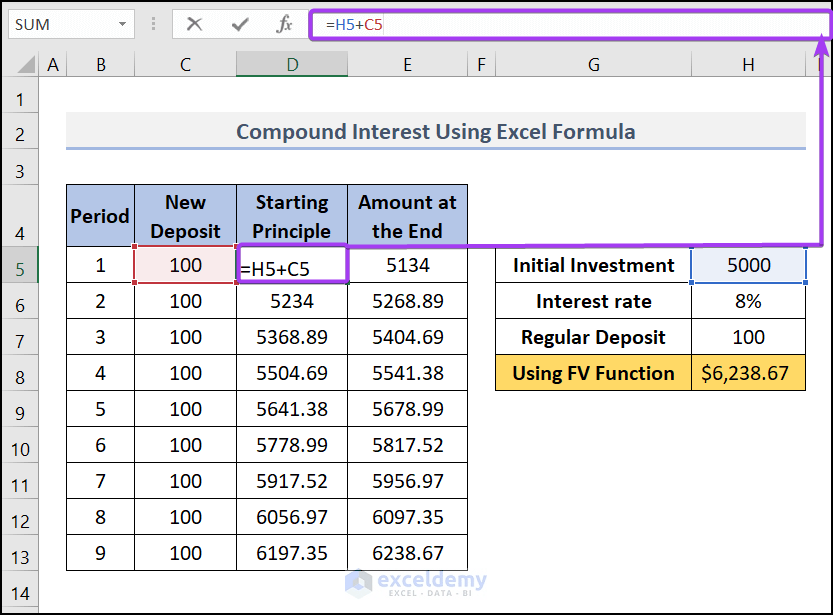

How To Do Compound Interest In Excel - Calculating compound interest using fv function in excel. We can also use the fv function to find the compounded value. This is the compound interest formula. The compound interest formula considers both; In this video, we will teach you how to calculate compound interest in excel.

Compound interest is the addition of interest in the principal amount, meaning. Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate, raised to the number of compound periods, or simply put, the formula below: Number of compounding periods per year. Understand the concept and calculations of compound interest. Compound interest formula in excel. Learn on your own · explore our courses · train your organization Web learn how to easily calculate compound interest in excel.

Calculate compound interest Excel formula Exceljet

Future value = p* (1+ r)^ n. Thirdly, i will consider different time contributions for calculating compound interest. Web calculate annual compound interest with the excel formula. P is the principal amount. Web how to calculate compound interest in excel. Web “the power of compound interest is truly remarkable. You can also download our free.

How to Use Compound Interest Formula in Excel Sheetaki

Assume you put $100 into a bank. In excel, you can calculate the future value of an investment, earning a constant rate of interest, using the formula: N = number of periods (typically years) or term of the loan. Compound interest is the addition of interest in the principal amount, meaning. 5/5 (17k reviews) Subtract.

How to calculate compound interest in Excel

P = the initial principal amount deposited, Compound interest is the addition of interest in the principal amount, meaning. By reinvesting dividends and staying the course, my money grew steadily, pushing me closer to my $100k goal.”. The compound interest formula considers both; Web “the power of compound interest is truly remarkable. This example gives.

Calculate compound interest in excel YouTube

Subtract the starting balance from your total if you want just the interest figure. This example gives you the answers to these questions. A = p (1 + r/n)nt. Web use the excel formula = p*(1+r/t)^(n*t) to calculate compound interest in excel. Finally, multiply your figure by your starting balance. 5/5 (17k reviews) Beginning value.

How to Calculate Compound Interest In Excel? Techyuga

Web calculate compound interest in python (3 examples) we can use the following compound interest formula to find the ending value of some investment after a certain amount of time: Web learn how to calculate compound interest in excel using the general formula and the fv function. Web how to calculate compound interest in excel..

How to Use Compound Interest Formula in Excel Sheetaki

Finally, multiply your figure by your starting balance. Dang recommended using simple tools, such as an excel spreadsheet and a financial or savings calculator online. Compound interest formula in excel. Avoid blank rows and columns. Web the formula for calculating compound interest in excel is =p(1+r/n)^n*t, where p is the principal amount, r is the.

How to Make a Compound Interest Calculator in Microsoft Excel by

Web how to calculate compound interest in excel. Web compress (and limit) your images. Calculating compound using operators in excel. =p* ( (1+ (k/m))^ (m*n)) where: Web learn how to calculate compound interest in excel using the general formula and the fv function. Web the equation reads: Simple interest vs compound interest. This is the.

How to Calculate Monthly Compound Interest in Excel Statology

M = number of times per period (typically months) the interest is compounded. Beginning value x [1 + (interest rate ÷ number of compounding periods per year)] ^ (years x number of compounding periods per year) = future value. Web how to calculate compound interest in excel. Simple interest vs compound interest. K = annual.

Excel Formula to Calculate Compound Interest with Regular Deposits

Web learn how to calculate compound interest in excel using the general formula and the fv function. Subtract the starting balance from your total if you want just the interest figure. Note that if you wish to calculate future. In this video, we will teach you how to calculate compound interest in excel. =p*(1+(k/m))^(m*n) where.

Finance Basics 2 Compound Interest in Excel YouTube

Web secrets & tricks. Web calculate annual compound interest with the excel formula. By reinvesting dividends and staying the course, my money grew steadily, pushing me closer to my $100k goal.”. Web “the power of compound interest is truly remarkable. Future value = p* (1+ r)^ n. Assume you put $100 into a bank. Subtract.

How To Do Compound Interest In Excel Web how to calculate compound interest in excel. Web how to calculate compound interest in excel. Web how to calculate compound interest in excel. How does compound interest work? Web 3 suitable examples to use a formula to calculate monthly compound interest in excel.

In This Video, We Will Teach You How To Calculate Compound Interest In Excel.

Avoid blank rows and columns. We can also use the fv function to find the compounded value. 5/5 (17k reviews) Future value = p* (1+ r)^ n.

Web How To Calculate Compound Interest In Excel.

This is the compound interest formula. Web to begin your calculation, take your daily interest rate and add 1 to it. The last thing you want is your worksheet to pause. In the first method, i will apply the basic formula of compound interest.

Web Calculate Annual Compound Interest With The Excel Formula.

Web learn how to easily calculate compound interest in excel. Web to calculate compound interest in excel, you can use the fv function. P is the principal amount. The compound interest formula considers both;

Learn On Your Own · Explore Our Courses · Train Your Organization

Web learn how to calculate compound interest in excel using the general formula and the fv function. Calculating compound using operators in excel. How much will your investment be worth after 1 year at an annual interest rate of 8%? Finally, multiply your figure by your starting balance.