How To Compute Compound Interest In Excel

How To Compute Compound Interest In Excel - Web in this article, i will show you four easy ways to use the compound interest formula in excel. How much will your investment be worth after 1 year at an annual interest rate of 8%? Web excel has an inbuilt formula for calculating compound interest, which is: Web in this tutorial, we’ll explain how to calculate simple compound interest, reverse compound interest, and continuous compound interest with examples in excel. Web calculate annual compound interest with the excel formula.

Web calculate annual compound interest with the excel formula. Finally, use the formula =pmt (rate, nper, pv) where rate is the. M is the number of compounding periods per annum. You will also find the detailed steps to create your own e xcel compound interest calculator. Next, enter the number of compounding periods per year in a separate cell. Understand the concept and calculations of compound interest. How much will your investment be worth after 1 year at an annual interest rate of 8%?

How to Calculate Compound Interest In Excel? Techyuga

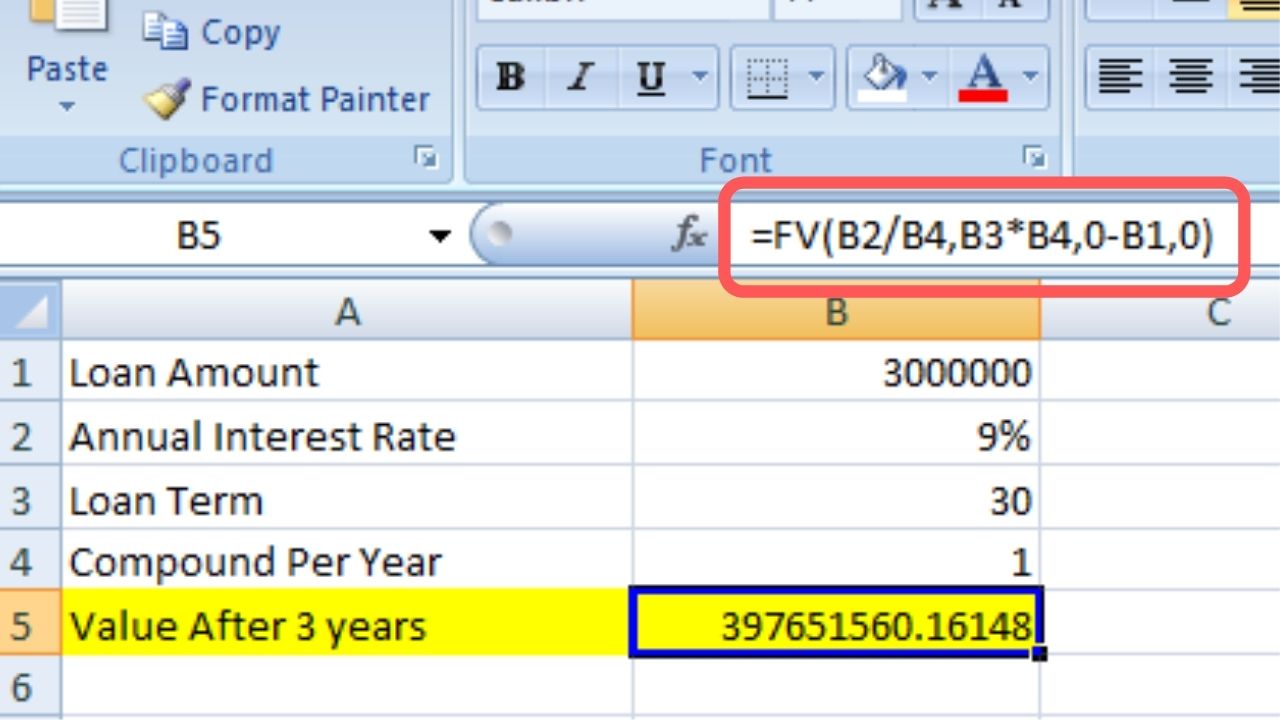

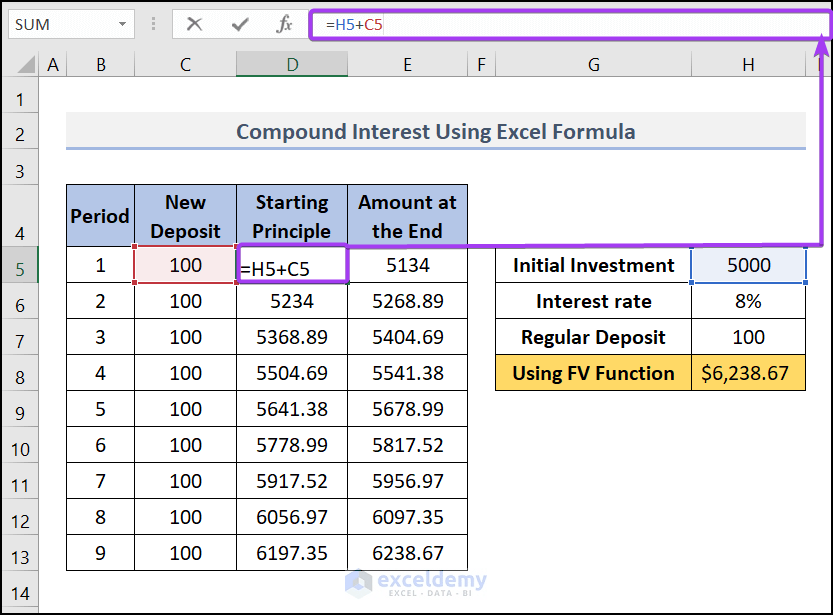

We can also use the fv function to find the compounded value. Web calculating compound interest in excel is a straightforward process that can be done using a simple formula. First, enter the initial investment amount in a cell. Compound interest with monthly compounding periods. Web to calculate compound interest in excel, you can use.

How to Use Compound Interest Formula in Excel Sheetaki

By referencing the appropriate cells for the principal, interest rate, and number of years, you can easily calculate the compound interest and final amount for any investment scenario. Web how to calculate compound interest in excel. This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly..

How to Use Compound Interest Formula in Excel Sheetaki

Where, p is the initial amount invested; Web in this tutorial, we’ll explain how to calculate simple compound interest, reverse compound interest, and continuous compound interest with examples in excel. The compound interest formula considers both; N is the number of periods. Web learn how to calculate compound interest using three different techniques in microsoft.

Calculate compound interest Excel formula Exceljet

In the first method, i will apply the basic formula of compound interest. The present value of the investment. In this article, we'll walk you through both these methods, and by the end, you'll be calculating compound interests like a pro. K = annual interest rate paid. Web you can calculate compound interest using the.

How to calculate compound interest in Excel

So at the end of year 1, you get usd 1100 (1000+100). Formula for a series of payments. Calculate the simple growth rate (sgr) and compound annual growth rate (cagr) of the country’s gdp over the decade. Web learn how to calculate compound interest using three different techniques in microsoft excel. T is the number.

Excel Formula to Calculate Compound Interest with Regular Deposits

The gdp of a country was $1.5 trillion in 2010 and increased to $2.5 trillion in 2020. So at the end of year 1, you get usd 1100 (1000+100). Web to calculate compound interest in excel, you can use the fv function. P = the initial principal amount deposited, K = annual interest rate paid..

How to Calculate Monthly Compound Interest in Excel Statology

We can also use the fv function to find the compounded value. Then, raise that figure to the power of the number of days you want to compound for. =p*(1+(k/m))^(m*n) where the following is true: Thirdly, i will consider different time contributions for calculating compound interest. Future value = p* (1+ r)^ n. Web excel.

Finance Basics 2 Compound Interest in Excel YouTube

This formula will give you the future value of the investment. Web in excel, you can calculate compound interest using the formula: Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate, raised to the number of compound periods, or simply put, the formula below: Then, in another.

How to Make a Compound Interest Calculator in Microsoft Excel by

Then, raise that figure to the power of the number of days you want to compound for. How much will your investment be worth after 1 year at an annual interest rate of 8%? Let me take a simple example to explain it. The compound interest formula considers both; Assume you put $100 into a.

How to Make a Compound Interest Calculator in Microsoft Excel by

Web using excel fv function to calculate compound interest. Next, enter the number of compounding periods per year in a separate cell. How much will your investment be worth after 1 year at an annual interest rate of 8%? This example gives you the answers to these questions. Compound interest is calculated by multiplying the.

How To Compute Compound Interest In Excel Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate, raised to the number of compound periods, or simply put, the formula below: Web calculate compound interest using excel formula with regular deposits: M = number of times per period (typically months) the interest is compounded. Next, enter the number of compounding periods per year in a separate cell. Web how to calculate compound interest in excel.

In This Article, We'll Walk You Through Both These Methods, And By The End, You'll Be Calculating Compound Interests Like A Pro.

The future value of the investment. Compound interest formula in excel. Simple interest is the interest we all know. R is the annual interest rate.

By Referencing The Appropriate Cells For The Principal, Interest Rate, And Number Of Years, You Can Easily Calculate The Compound Interest And Final Amount For Any Investment Scenario.

How much will your investment be worth after 1 year at an annual interest rate of 8%? This is the amount you will get at the end. Web calculating compound interest in google sheets is a simple and efficient process. N = number of periods (typically years) or term of the loan.

The Compound Interest Formula Considers Both;

Although it can apply to both savings and loans, it is easiest to understand when thinking about savings. Understand the concept and calculations of compound interest. First, enter the initial investment amount in a cell. Web the general equation to calculate compound interest is as follows.

M = Number Of Times Per Period (Typically Months) The Interest Is Compounded.

This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly. Compound interest refers to earning or paying interest on interest. Note that if you wish to calculate future. Suppose you invest usd 1000 in a bank account that promises to give you 10% return at the end of the year.