How To Calculate Tax In Excel

How To Calculate Tax In Excel - The income statement tab utilizes a handy sumif formula for each line item on the inc stmt detail tab. How to use the sum function for tax calculations. To illustrate how to calculate taxes, we’ll use the following tax rate sample: Financial statements of the business that include income statement, balance sheet, and cash flow statement. Discussing the variables involved in the formula.

Web how to calculate federal tax rate in excel? Calculating tax percentage in excel is crucial for financial data analysis and budget management. If the amount is less than $1000, only the base tax applies. Web the goal is to calculate a tax amount with both fixed and variable components according to the following logic: Step 2) add the interest expense to it. Separate your income and expenses data into different sections or sheets within the same workbook. This problem can be easily solved with the if function.

How to Calculate Tax in Excel Using IF Function (With Easy Steps)

Web in this microsoft excel tutorial, i'll teach you how to calculate your federal income tax based on your taxable income. For this, i will use the schedule. If the amount is less than $1000, only the base tax applies. Input the values into the formula. Web classify each line to an income/expense category using.

tax calculating formula in Excel javatpoint

To start, you will need the following: Tax laws of the country where the business operates. There are several variables involved in the sales tax formula: Step 2) add the interest expense to it. If the amount is $1000 or greater, the result is the base tax + 15% * the amount over $1000. Ensure.

Tax rate calculation with fixed base Excel formula Exceljet

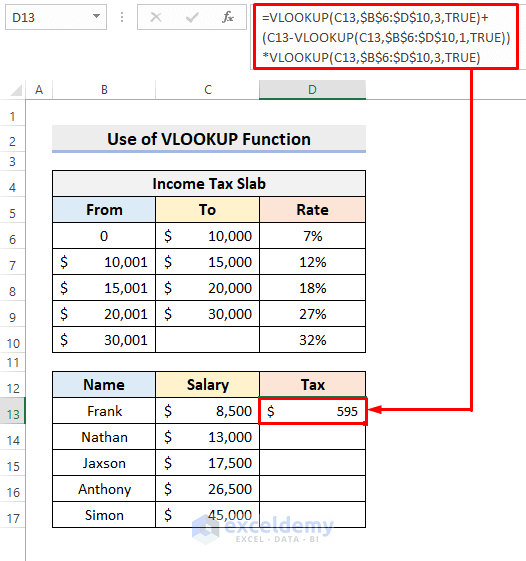

The tax season is well and truly upon us. This example teaches you how to calculate the tax on an income using the vlookup function in excel. Calculating tax percentage in excel is crucial for financial data analysis and budget management. The sum function in excel allows you to quickly add up multiple cells. The.

How to Calculate Tax in Excel Using IF Function (With Easy Steps)

The following examples show how to use each formula in practice. Once selected, the ‘ developer ’ tab should appear at the top of your document, next to ‘ help ’. The formula in g5 is: Calculating the right amount of tax can be difficult. Web use the formula =net_price* (1+sales_tax_rate) in excel. The answer.

Calculate Tax in Excel AY 202324 Template & Examples

It is mainly intended for residents of the u.s. Web income tax bracket calculation. Step 1) pick out the net profit of this company. The formula in g5 is: How to use the sum function for tax calculations. This problem can be easily solved with the if function. The income statement tab utilizes a handy.

How to Calculate Taxes in Excel

Separate your income and expenses data into different sections or sheets within the same workbook. Tax = taxable income x tax rate. Begin by creating a new excel spreadsheet and labeling it with the appropriate tax year. The following examples show how to use each formula in practice. Discussing the variables involved in the formula..

How to Calculate Tax on Salary with Example in Excel

Web excel is a powerful tool that can be used for calculating deferred taxes. = vlookup ( amount, tax_data,2,true) explanation. Web in this video, i use a simple excel example to show how you can calculate federal income taxes depending on your taxable income and tax bracket. The sum function in excel allows you to.

How to Calculate Tax in Excel Using IF Function (With Easy Steps)

In this tutorial, we will explore the common tax calculations and provide examples of how to use these formulas in excel. 130k views 4 years ago. This simple formula allows you to calculate the tax amount on a given price based on the tax rate. For this, i will use the schedule. In this example,.

how to calculate tax in excel using formula YouTube

Web in this post, we’ll examine a couple of ideas for computing income tax in excel using tax tables. Web how to calculate federal tax rate in excel? Organizing income and expenses data. There are several variables involved in the sales tax formula: Web in this microsoft excel tutorial, i'll teach you how to calculate.

Chapter 1 Excel Part II How to Calculate Corporate Tax YouTube

This will give you the amount of tax owed based on the taxable income and tax rate. Organizing income and expenses data. Web excel is a powerful tool that can be used for calculating deferred taxes. Web when it comes to calculating taxes in excel, it’s important to understand the basic tax formulas and how.

How To Calculate Tax In Excel Web when it comes to calculating taxes in excel, it’s important to understand the basic tax formulas and how they are used. Microsoft excel offers several standard functions that can be used to calculate your effective tax rate using your income breakdown by tax bracket. Excel spreadsheet with appropriate formulas and functions. This simple formula allows you to calculate the tax amount on a given price based on the tax rate. Web use the formula =net_price* (1+sales_tax_rate) in excel.

This Gives The Total Amount Payable Including Sales Tax.

Begin by creating a new excel spreadsheet and labeling it with the appropriate tax year. Your taxable income needs to be divided into the correct cells according to irs tax brackets. Web your effective tax rate can be calculated using microsoft excel through a few standard functions and an accurate breakdown of your income by tax bracket. Web income tax bracket calculation.

It Is Mainly Intended For Residents Of The U.s.

Identify the initial value and the final value. Understanding the formula for tax percentage calculation and applying it to different scenarios is important for accuracy and efficiency. This example teaches you how to calculate the tax on an income using the vlookup function in excel. Specifically, we’ll use vlookup with a helper column, we’ll remove the helper column with sumproduct, and then we’ll use data validation and the indirect function to make it easy to pick the desired tax table, such as single or.

Remove Sales Tax From Price.

The answer is the percent increase. Excel spreadsheet with appropriate formulas and functions. 130k views 4 years ago. Web use the formula =net_price* (1+sales_tax_rate) in excel.

I Have Deducted B14 From B16 Since The Interest Expense Appears As A Negative Number In The Income Statement.

This will give you the amount of tax owed based on the taxable income and tax rate. Step 2) add the interest expense to it. The following tax rates apply to individuals who are residents of australia. Multiply the result by 100.