How To Calculate Payback Period In Excel

How To Calculate Payback Period In Excel - In a third cell (e.g., c1 ), input the formula = (a1/b1)*100 to calculate the roi. Web setting up an excel spreadsheet with the necessary formulas is a helpful tool for calculating the payback period. Enter the initial investment and cash flows for each period in separate columns. The payback period is the amount of time needed to recover the initial outlay for an investment. Web payback period = initial investment / annual cash flow.

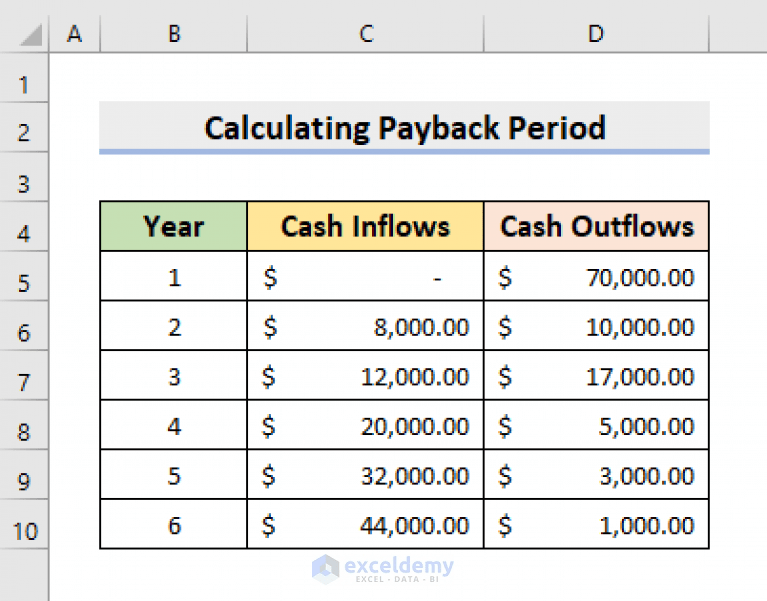

Time value of money is neglected 2. Learn how to calculate it with. Web in excel, you can easily calculate the cumulative cash flow by summing up the cash inflows for each period. Web setting up an excel spreadsheet with the necessary formulas is a helpful tool for calculating the payback period. Web payback period = initial investment / annual cash flow. Web use the =match() function in excel to determine the exact year in which the cumulative cash flow becomes positive. In this example, we’ll type cash inflows and cash outflows of 6 years.

How to Calculate Payback Period in Excel? QuickExcel

By following these simple steps, you can easily calculate the payback period in excel. Web use the =match() function in excel to determine the exact year in which the cumulative cash flow becomes positive. Web in its simplest form, the formula to calculate the payback period involves dividing the cost of the initial investment by.

What is Payback Period? Formula + Calculator

Enter financial data in your excel worksheet. In this example, we’ll type cash inflows and cash outflows of 6 years. Web to build a payback period calculation template in excel, follow these steps: Web setting up an excel spreadsheet with the necessary formulas is a helpful tool for calculating the payback period. Web payback period.

How to Calculate Payback Period in Excel (With Easy Steps)

Use autofill to complete the rest. Enter financial data in your excel worksheet. Web to build a payback period calculation template in excel, follow these steps: Time value of money is neglected 2. Web formula for payback period = initial investment/net annual cash inflow limitations of payback period: This cumulative cash flow helps you track.

How to Calculate Payback Period in Excel (With Easy Steps)

Payback period = initial investment ÷ cash flow per year. By following these simple steps, you can easily calculate the payback period in excel. Web setting up an excel spreadsheet with the necessary formulas is a helpful tool for calculating the payback period. Web formula for payback period = initial investment/net annual cash inflow limitations.

Payback Period Formula Calculator (Excel template)

Web formula for payback period = initial investment/net annual cash inflow limitations of payback period: Interpreting the results of the payback period calculation can provide valuable insights for comparing investment options. Web setting up an excel spreadsheet with the necessary formulas is a helpful tool for calculating the payback period. Calculate the cumulative cash flow.

How to Calculate Discounted Payback Period in Excel

The payback period is the amount of time needed to recover the initial outlay for an investment. Web in an excel spreadsheet, list the net profit in one cell (e.g., a1) and the total investment in another cell (e.g., b1 ). Web formula for payback period = initial investment/net annual cash inflow limitations of payback.

How To Calculate Payback Period In Excel Using Formula

In this example, we’ll type cash inflows and cash outflows of 6 years. Time value of money is neglected 2. Web formula for payback period = initial investment/net annual cash inflow limitations of payback period: Web steps to calculate payback period in excel. This cumulative cash flow helps you track the total amount of cash.

How to calculate PAYBACK PERIOD in MS Excel Spreadsheet 2019 YouTube

By following these simple steps, you can easily calculate the payback period in excel. Without any further ado, let’s get started with calculating the payback period in excel. Web payback period = initial investment / annual cash flow. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or “cumulative cash.

How to Calculate the Payback Period With Excel

In a third cell (e.g., c1 ), input the formula = (a1/b1)*100 to calculate the roi. Enter financial data in your excel worksheet. Payback period = initial investment ÷ cash flow per year. Web to build a payback period calculation template in excel, follow these steps: Calculate the net/ cumulative cash flow. This formula divides.

How to Calculate Payback Period in Excel (With Easy Steps)

Interpreting the results of the payback period calculation can provide valuable insights for comparing investment options. By following these simple steps, you can easily calculate the payback period in excel. Without any further ado, let’s get started with calculating the payback period in excel. Web to build a payback period calculation template in excel, follow.

How To Calculate Payback Period In Excel Web in an excel spreadsheet, list the net profit in one cell (e.g., a1) and the total investment in another cell (e.g., b1 ). In this example, we’ll type cash inflows and cash outflows of 6 years. This cumulative cash flow helps you track the total amount of cash received over time and determines when the initial investment is recovered. By following these simple steps, you can easily calculate the payback period in excel. This formula divides net profit by total investment and multiplies the result by 100 for percentage representation.

Learn How To Calculate It With.

Web setting up an excel spreadsheet with the necessary formulas is a helpful tool for calculating the payback period. Payback period = initial investment ÷ cash flow per year. This cumulative cash flow helps you track the total amount of cash received over time and determines when the initial investment is recovered. Web to build a payback period calculation template in excel, follow these steps:

Use Autofill To Complete The Rest.

In this example, we’ll type cash inflows and cash outflows of 6 years. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or “cumulative cash flow” by applying the. Use conditional formatting to highlight the period in which the investment is recouped. Enter financial data in your excel worksheet.

Interpreting The Results Of The Payback Period Calculation Can Provide Valuable Insights For Comparing Investment Options.

Enter the initial investment and cash flows for each period in separate columns. By following these simple steps, you can easily calculate the payback period in excel. Without any further ado, let’s get started with calculating the payback period in excel. Web in excel, you can easily calculate the cumulative cash flow by summing up the cash inflows for each period.

This Formula Divides Net Profit By Total Investment And Multiplies The Result By 100 For Percentage Representation.

The payback period is the amount of time needed to recover the initial outlay for an investment. Web payback period = initial investment / annual cash flow. In a third cell (e.g., c1 ), input the formula = (a1/b1)*100 to calculate the roi. Calculate the cumulative cash flow for each period.