How To Calculate Interest On A Loan Excel

How To Calculate Interest On A Loan Excel - Cumipmt (rate, nper, pv, start_period, end_period, type) where: The second argument specifies the payment number. Input the term of the loan in years in cell d5. Pmt (rate, nper, pv, [fv], [type]). Beginning value x [1 + (interest rate ÷ number of compounding periods per year)] ^ (years x number of compounding periods per year) = future.

Input the term of the loan in years in cell d5. Nper is the total number of payments. (many of the links in this article redirect to a specific reviewed product. Web to calculate a loan payment amount, given an interest rate, the loan term, and the loan amount, you can use the pmt function. One of the best ways to keep up with your loan, payments, and interest is with a handy tracking tool and loan calculator for excel. With a monthly payment schedule, we will need to make sure we convert any annual numbers to monthly. Web the decimal will be converted into a percentage.

Interest Rate Calculation in Excel YouTube

The total number of payment periods. Web how to calculate loan interest in excel. We divide the value in c6 by 12 since 4.5% represents annual interest: You can enter a beginning. Web the pmt function uses the following syntax: Web the general formula for simple interest is: We use named ranges for the input.

Mortgage Loan Calculator Using Excel TurboFuture

Pmt (rate, nper, pv, [fv], [type]). Web use the excel formula coach to figure out a monthly loan payment. Then, c8 denotes the total payment period in terms of the year which is 5. The total number of payment periods. The pmt function syntax has the following arguments: Web prior to using the goal seek.

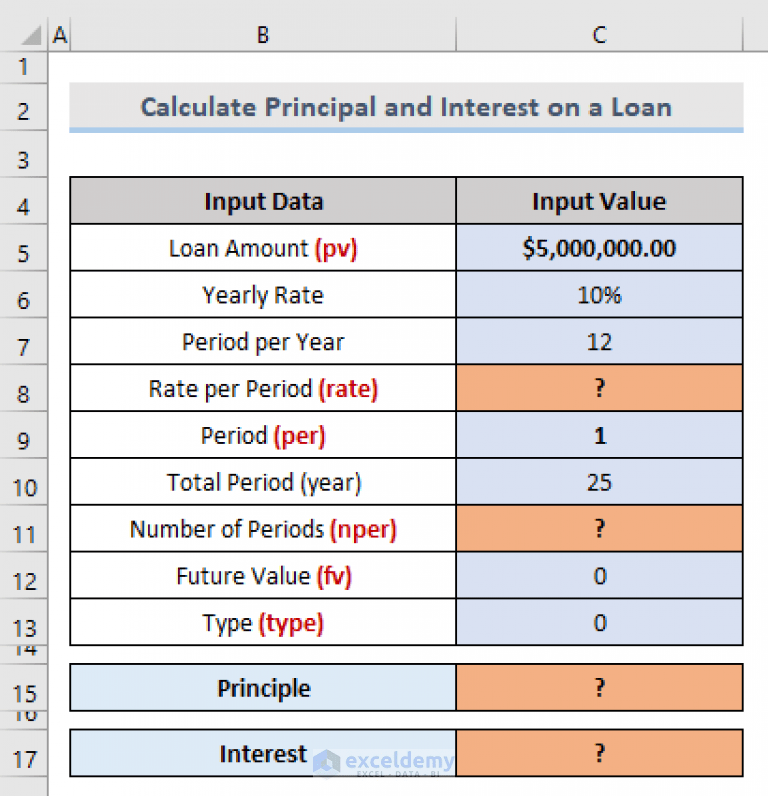

How to Calculate Principal and Interest on a Loan in Excel ExcelDemy

The second argument specifies the payment number. So, using cell references, we have: Beginning value x [1 + (interest rate ÷ number of compounding periods per year)] ^ (years x number of compounding periods per year) = future. For example, it can calculate interest rates in situations where car dealers only provide monthly payment information.

how to calculate principal and interest on a loan in excel YouTube

4% (expressed as a decimal, so 4% becomes 0.04) loan term: In the example shown, the formula in c10 is: Pv is the principal loan amount (total loan amount). For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year. Use the ppmt function to.

How To Use Excel's Loan Calculator Get The Simple Template Here

We use named ranges for the input cells. In the payment row, use the formula =ipmt(b2, 1, b3, b1) to calculate the interest payment. Input into cell d3 the amount of the loan. To do this, we set up cumipmt like this: Usually, it includes principal and interest, but no taxes. The second argument specifies.

Calculate payment for a loan Excel formula Exceljet

Rate (nper, pmt, pv, [fv], [type], [guess]) where: Use the ppmt function to calculate the principal part of the payment. At the same time, you'll learn how to use the pmt function in a formula. We divide the value in c6 by 12 since 4.5% represents annual interest: The first three arguments are required and.

How to Calculate the Total Interest on a Loan in Excel YouTube

Web to calculate the periodic interest rate for a loan, given the loan amount, the number of payment periods, and the payment amount, you can use the rate function. Pmt (rate, nper, pv, [fv], [type]). Starting value of the loan) This function uses the following syntax: Then, c8 denotes the total payment period in terms.

Calculate loan interest in given year Excel formula Exceljet

Web the first step to calculating your loan interest in excel is to create a data table with the relevant information. Web to calculate a loan payment amount, given an interest rate, the loan term, and the loan amount, you can use the pmt function. Nper is the total number of payments. To do this,.

How To Calculate Loan Payments Using The PMT Function In Excel Excel

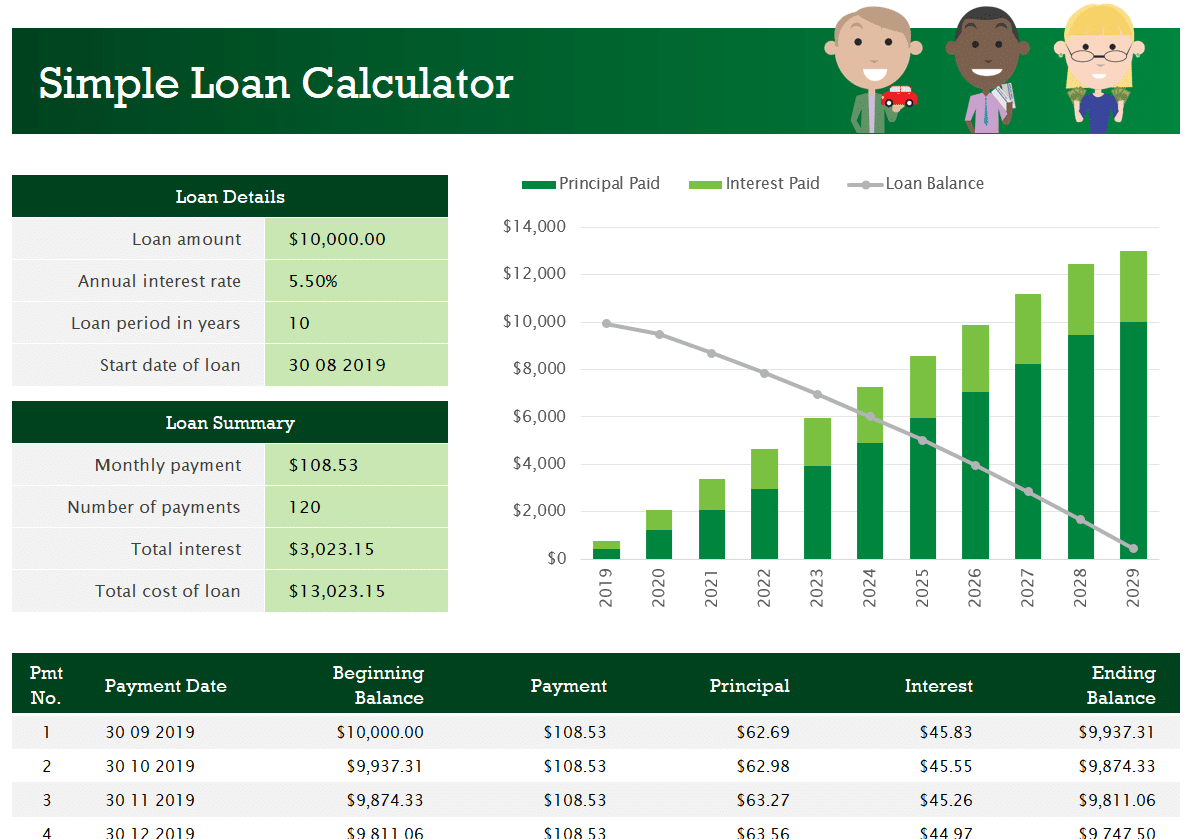

One of the best ways to keep up with your loan, payments, and interest is with a handy tracking tool and loan calculator for excel. Web the first step to calculating your loan interest in excel is to create a data table with the relevant information. Input the repayment amount per month into cell d7..

Loan Amortization Schedule Spreadsheet —

= cumipmt ( rate, nper, pv, start, end, type) explanation. For the pv argument, enter the loan amount ($c$5). Input into cell d3 the amount of the loan. In the example shown, the formula in c10 is: To calculate the interest on investments instead, use. For example, it can calculate interest rates in situations where.

How To Calculate Interest On A Loan Excel Here, i have used the pmt function which calculates the monthly or annual payment based on a loan with a constant interest rate and regular payment. You can enter a beginning. The apr comes out as 8.33%. Web the general formula for simple interest is: The higher your interest rate, or yield, the more your bank balance grows.

At The Same Time, You'll Learn How To Use The Pmt Function In A Formula.

= cumipmt ( rate, nper, pv, start, end, type) explanation. Web the general formula for simple interest is: Input the term of the loan in years in cell d5. So, using cell references, we have:

The Total Number Of Payment Periods.

The rate argument is the interest rate per period for the loan. These templates cover the most common types of loans and are all available for free. Web here’s how you can calculate the total interest paid over the duration of a loan: The second argument specifies the payment number.

The First Three Arguments Are Required And What We Will Focus On.

The higher your interest rate, or yield, the more your bank balance grows. Here, i have used the pmt function which calculates the monthly or annual payment based on a loan with a constant interest rate and regular payment. Web the syntax is as follows: For a more complete description of the arguments in pmt, see the pv function.

For This Step, You Might Want To Include Cells For The Principal Amount Of The Loan, Your Annual Interest Rate, How Many Years You Plan To Repay The Loan, What Your Starting Period Is And What Your Ending Period Is.

Web things you should know. The interest rate of the loan. It is easy and simple to calculate apr in excel. Create row headers for principal, interest, periods, and payment.